Search

Big Tech in financial system poses concentration risk

October 19, 2022

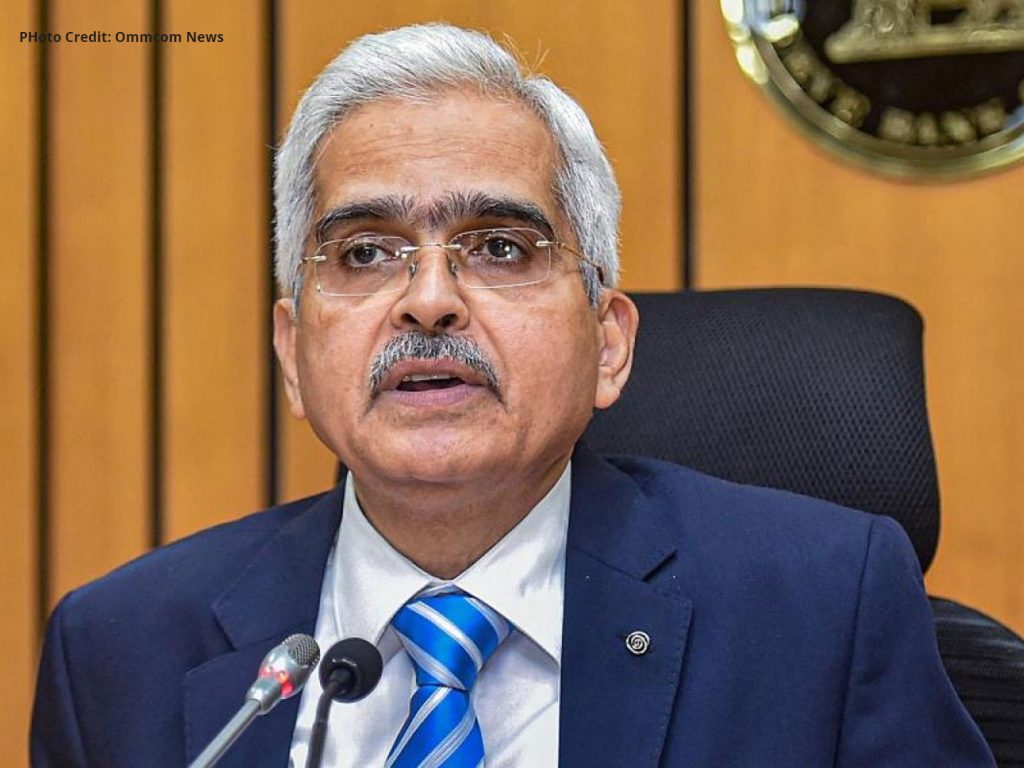

“Enormous amounts of consumer data is being generated and leveraged upon by a few entities (the so-called Big Tech) by virtue of their huge customer base. Such developments raise concerns on concentration risk and potential spillovers as their level of engagement with the financial system strengthens in the years to come,” Das said at the Global Fintech Fest 2022.

“Therefore, potential risks to public policy objectives of maintaining competition, market and business conduct, operational resilience, data privacy, cyber security and financial stability need closer attention,” he said.

RBI in the past had flagged the increased engagement of Big Tech in the financial services space, which has implications for financial stability.

Big Tech companies such as Google, Amazon, and WhatsApp are already involved in India’s payment ecosystem, involving Unified Payments Interface (UPI). The regulator has said that use of digital channels in financial services is a welcome move. However, the potential downside risks embedded in such endeavours need to be addressed.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://tscfm.org/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/