Search

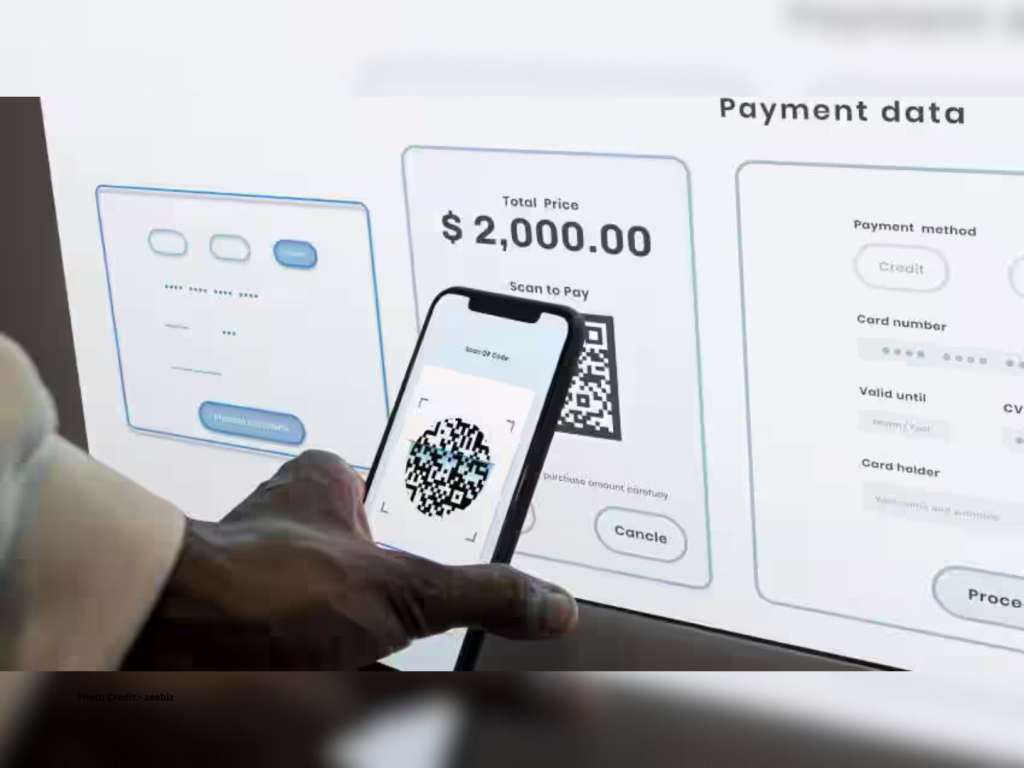

ICICI Bank allows users to convert UPI payments into EMI

April 14, 2023

“We have seen that maximum payments these days are made through UPI. In addition, we have observed that customers are increasingly opting for UPI transactions from PayLater- the Bank’s ‘buy now, pay later’ service. Combining these two trends, we are introducing the facility of instant EMI for UPI payments done through PayLater,” added Bijith Bhaskar, Head- Digital Channels & Partnership, ICICI Bank.

Banks clarified that the facility can be availed across a host of categories such as electronics, groceries, fashion apparel, travel, and hotel bookings. As of now, the bank has allowed a transaction amount of above ₹10,000 in easy installments in three, six, or nine months. Also, the bank has added that the EMI facility for PayLater will shortly be extended for online shopping as well.

ICICI Bank has informed how the customers can avail the EMI facility on PayLater:

Customers need to visit any physical store and choose their preferred product or service. To make the payment, use the iMobile Pay app, the official bank app, and choose the ‘Scan any QR’ option. Select the PayLater EMI option if the transaction amount is ₹10,000 or more. Select the tenure of repayment, it could be 3, 6, or 9 months. Confirm the payment and the transaction is completed successfully.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://tscfm.org/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/