Search

Mutual fund investments made easy with PhonePe

November 30, 2021

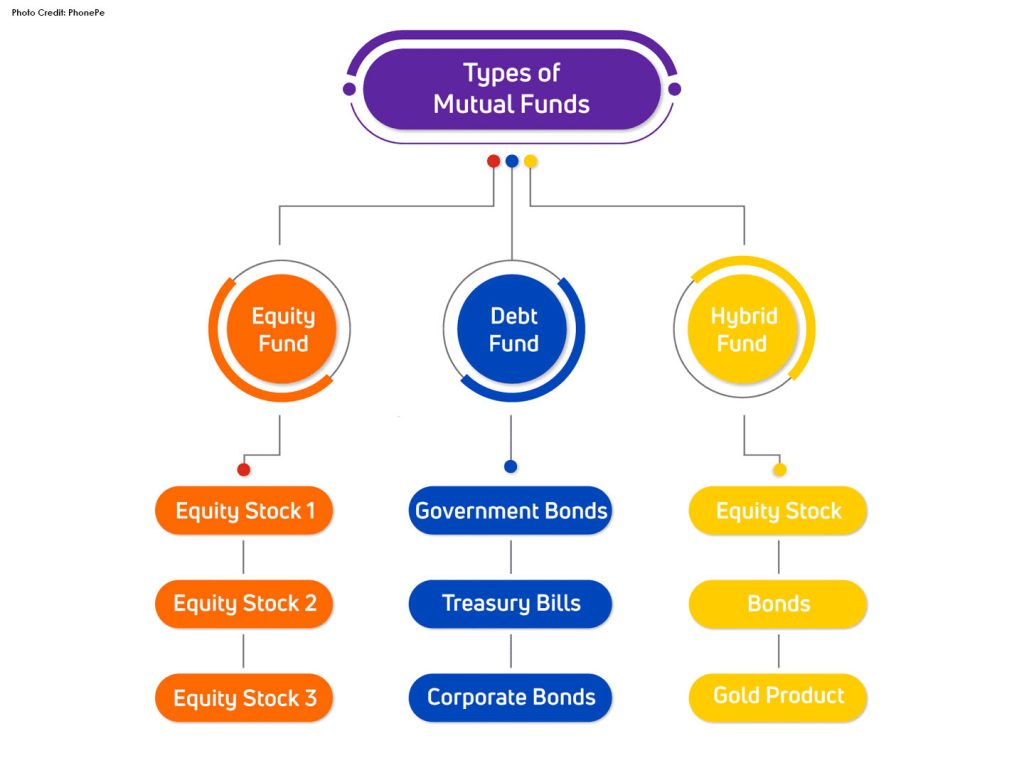

The Indian Mutual Fund industry has grown in the last 10 years and is now managing assets worth over ₹37 lakh crore.

The inherent benefits of mutual funds like professional fund management, choice of schemes to suit diverse investing needs, transparency, robust regulations, low cost, high liquidity, and so on make it an optimal investment avenue for individual investors.

However, reaching the end client had consistently been a key challenge because of limited distribution reach. It’s just in the beyond 5 years that mutual funds have begun gaining huge popularity, because of the AMFI’s “Shared Funds Sahi Hai Campaign” and the emergence of digital investment platforms.

PhonePe, which had forayed into mutual fund delivery in 2019 with the launch of Tax Saving Funds, presently offers a total scope of mutual fund products through its organizations with in excess of 20 driving mutual funds organizations in the country. PhonePe has simplified the mutual fund investment process significantly and provided easy investment solutions to help investors make informed decisions.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://tscfm.org/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/