Search

RBI hikes repo rate by 50 basis points for second time

August 08, 2022

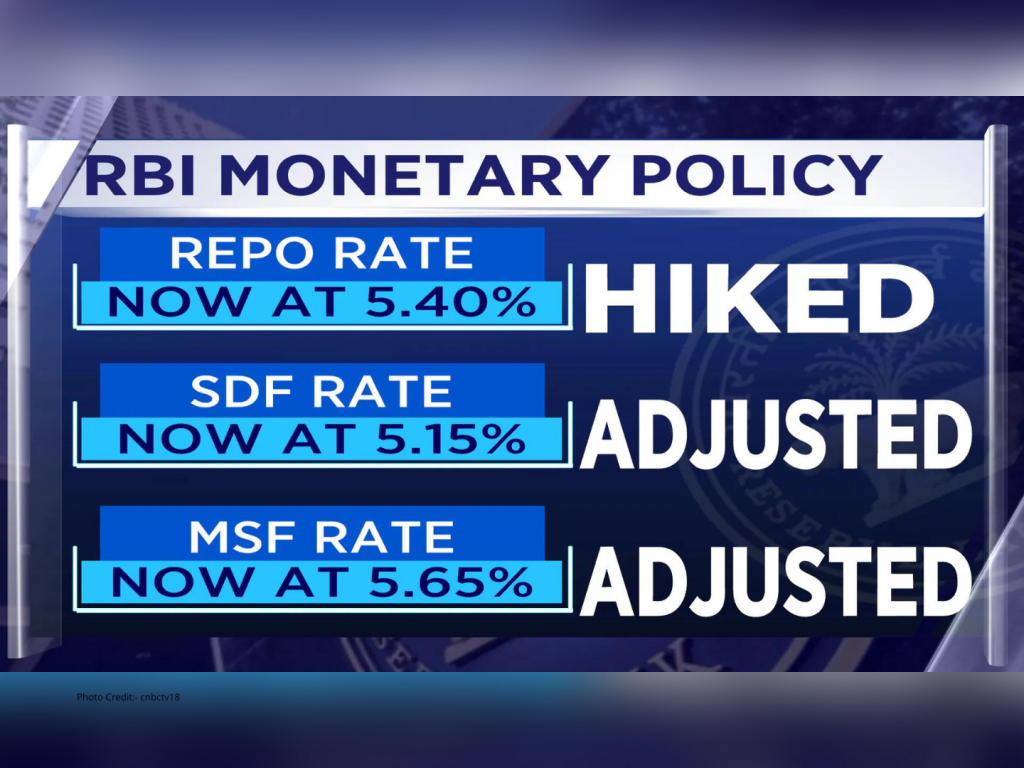

This was the second 50 bps hike in a row. The RBI has hiked the policy rate three times in a row now.

This decision comes as part of the RBI’s efforts to control inflation that recently hit a multi-year high, forcing major central banks worldwide to take the rate hike path.

“The MPC remains focused on the withdrawal of accommodation to ensure inflation remains within target going forward while supporting growth,” said Das while announcing the policy.

With this hike, the repo rate is returning to pre-pandemic levels, the highest since August 2019.

After a long pause during the COVID-19 period, the RBI started the rate increase cycle in May this year with a 40-basis-point hike in an unscheduled announcement. This was followed by another rate hike of 50 basis points in June.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://tscfm.org/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/