Search

RBI raises repo rate by 50bps to 5.4%

August 05, 2022

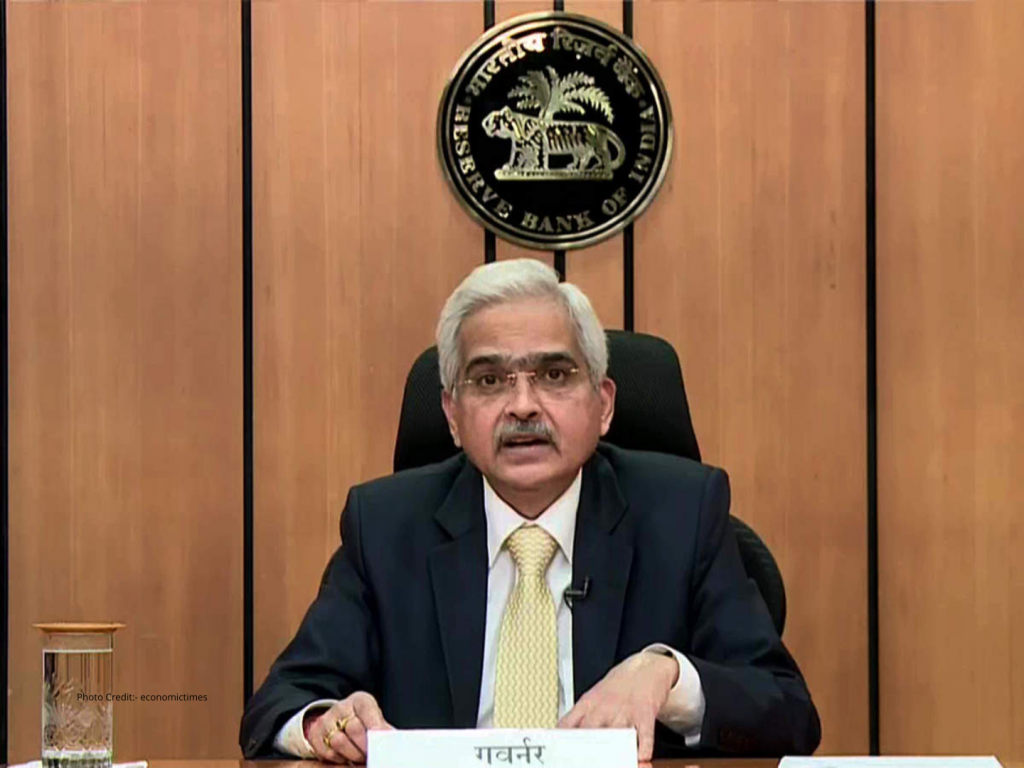

The Reserve Bank of India-led Monetary Policy Committee on Friday increased the repo rate by 50 basis points to 5.4% to take it to the pre-pandemic levels, as the monetary authority seeks to bring down inflation to its comfort band and in line with policy tightening by key central banks.

The Standing Deposit Facility (SDF) rate was adjusted to 5.15%, meanwhile, the Marginal Standing Facility and bank rate were revised to 5.65%. “The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth,” said RBI governor Shaktikanta Das.

The policy rate increase by the MPC comes as an attempt to curtail the inflationary pressures faced by citizens on the back of high food and fuel prices following supply disruptions due to Russia’s invasion of Ukraine. The increase also comes after the Indian rupee’s plunge to an all-time low in July that further bumped up imported inflation.

While talking about the rate hike, Dr. Aurodeep Nandi, India Economist and Vice President at Nomura, said “The RBI’s 50bp hike was largely in line with market expectations, that was divided between it and a 35bp hike. Very importantly, with the RBI retaining the policy stance of “withdrawal of accommodation”, the implicit message is that rates are yet to reach neutral territory, and that more rate hikes are warranted a view that we agree with. The RBI continues to signal that all options are on the table, which is a prudent strategy given the elevated levels of uncertainties on both, growth as well as inflation.”

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://tscfm.org/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/