Search

RBI to enable 75 villages for digital payments

March 10, 2023

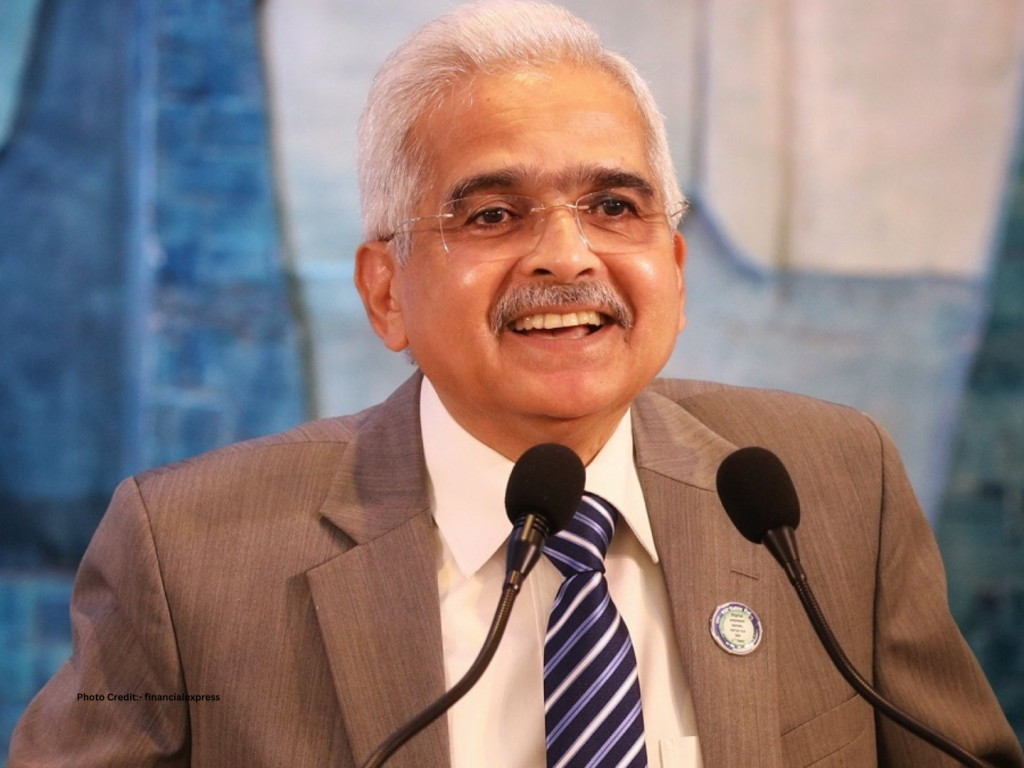

Reserve Bank of India’s Governor Shaktikanta Das on Monday announced the central bank will initiate a 75 Digital Villages programme to enable 75 villages across the country with digital payments through awareness and support from local entrepreneurs and merchants.

Launching the Har Payment Digital initiative to encourage digital payments adoption among people, Das said payment system operators (PSOs) will “adopt 75 villages in the country and convert them into digital payment-enabled villages,” under the 75 Digital Villages programme and in observance of 75 years of independence.

“They (PSOs) will conduct two camps in each of these villages to enhance awareness and onboard merchants in the village for digital payments,” Das said. “The payments ecosystem has a variety of payment systems that have facilitated migration to digital. Unified Payments Interface (UPI) has facilitated digital payments to merchants such as retail outlets, kirana stores, street vendors, etc. across the country,” he added.

PSOs are entities authorised by RBI to set up and operate a payment system. As of February 20, 2023, according to the data on the RBI’s website, there are 67 PSOs including NPCI, Mastercard, Visa, SBI, Punjab National Bank, Amazon Pay (India), PhonePe, Muthoot Finserv USA, Ola Financial Services, PayU Payments, and more under various categories such as retail payments organisations, card payment networks, ATM networks, prepaid payment instruments, etc.

Important Links:

- 4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI): https://tscfm.org/courses/4-in-1-professional-diploma-in-banking-financial-services-insurance-pdbfsi/