Search

Niti Aayog moots full stack Digital Banks in India

November 25, 2021

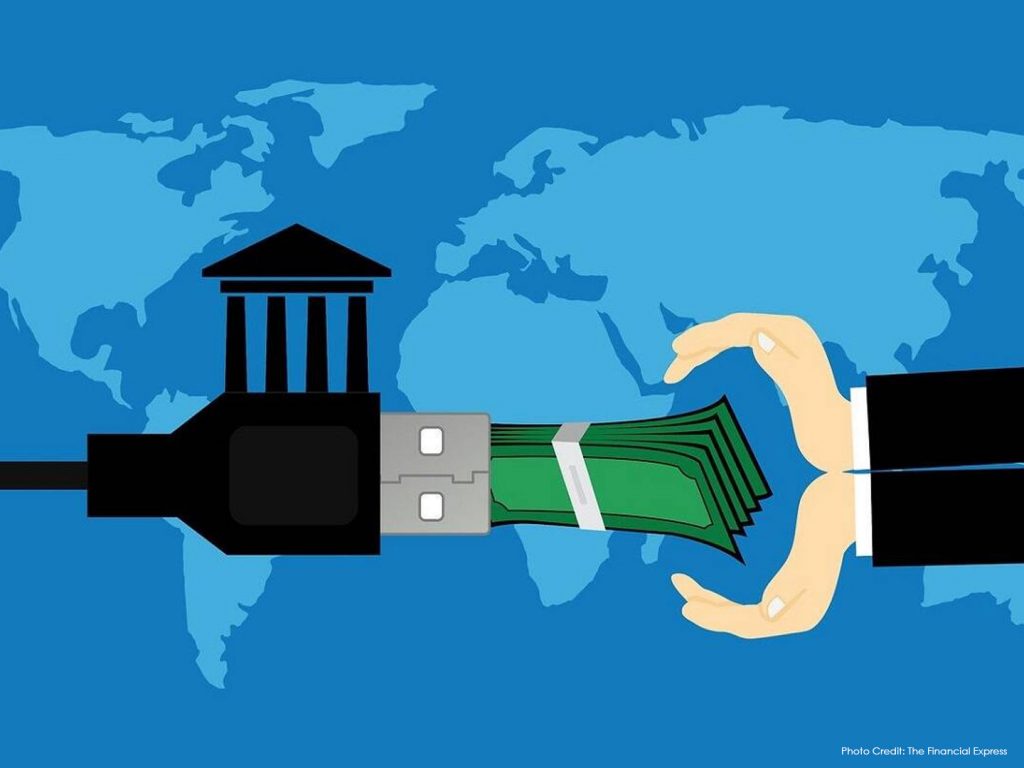

Niti Aayog Wednesday released a discussion paper to introduce new financial entities considered Digital Banks that would generally aim to connect the current credit hole for India’s MSMEs and get them into the formal financial fold.

The paper named Digital Banks, A Proposal for Licensing and Regulatory Regime for India published on the Niti Aayogs site and seeking comments till December 31, 2021, offers a guide for these full-stack Digital Banks alongside standards around their licensing and regulatory regime in the country.

These entities (digital banks) will issue deposits, make loans and proposition the full suite of services that the Banking Regulation Act, 1949 empowers them to.

As the name recommends, in any case, DBs will basically depend on the web and other general channels to offer their administrations and not physical branches, as per the discussion paper. Nonetheless, these banks will be subject to prudential and liquidity norms at par with the incumbent commercial banks.

According to IFC estimates, the complete addressable credit gap in the MSME fragment is ₹25.8 trillion growing 37 percent CAGR. The total addressable market demand by the MSME sector is roughly ₹37 trillion, of which banks, different other institutions and NBFCs supply about ₹10.9 trillion.

Important Links:

- Professional Diploma in Digital Marketing: https://tscfm.org/courses/professional-diploma-in-digital-marketing/

- Post Graduate Diploma in Management (PGDM): https://tscfm.org/courses/3-in-1-management-program/